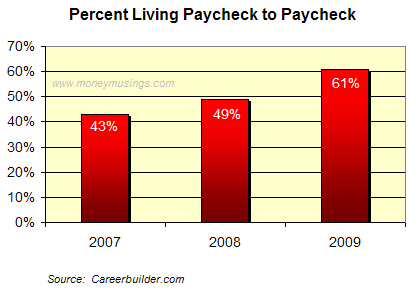

Those are the figures reported by a new survey from Careerbuilder.com, in which Harris Interactive surveyed 4,478 workers about their current financial standing. Sixty-one percent reported that they're living at or near a "paycheck to paycheck" basis. Further:

Surprisingly, people earning average salaries arenít the only ones feeling the need to pinch pennies: 30 percent of workers with salaries of $100,000 or more report that they too live paycheck to paycheck, up from 21 percent in 2008.

Admittedly, earning $100k in NYC isn't the same as earning $100k in Memphis, so the tangible value of the "$100k" aspect has to be moderated somewhat.

How has the recent economic tumult affected the paycheck-to-paycheck figures? Well, here's a visual:

And here's a nasty (though not unexpected) tidbit that does NOT bode well for the future:

Some workers are making ends meet by dipping into their long-term savings. More than one-in-five (21 percent) workers say they have reduced their 401(k) contributions or personal savings in the last six months to get by. Looking at workers earning six figures or more, a nearly equal number (23 percent) report that they have also reduced their 401(k) or savings.

Some other factoids from the survey:

- 36% of workers report no participation in 401k, IRA, etc.

- 33% say they are not able to save ANY money each month

- 30% say they are able to save $100 or less each month

- 16% say they are able to save $50 or less each month

Oy. Not a pretty picture, no matter how you look at it!

Labels: Spending, Statistics